| FindBook |

有 1 項符合

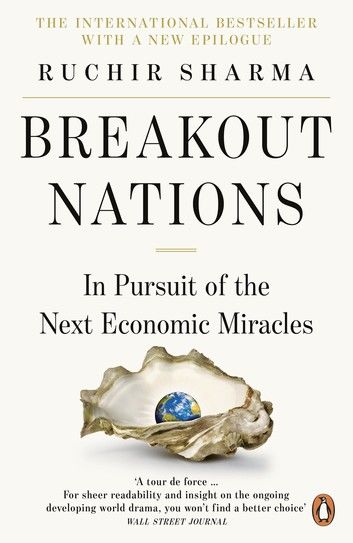

Breakout Nations的圖書 |

|

Breakout Nations 作者:Ruchir Sharma 出版社:Penguin 出版日期:2012-05-03 |

| 圖書館借閱 |

| 國家圖書館 | 全國圖書書目資訊網 | 國立公共資訊圖書館 | 電子書服務平台 | MetaCat 跨館整合查詢 |

| 臺北市立圖書館 | 新北市立圖書館 | 基隆市公共圖書館 | 桃園市立圖書館 | 新竹縣公共圖書館 |

| 苗栗縣立圖書館 | 臺中市立圖書館 | 彰化縣公共圖書館 | 南投縣文化局 | 雲林縣公共圖書館 |

| 嘉義縣圖書館 | 臺南市立圖書館 | 高雄市立圖書館 | 屏東縣公共圖書館 | 宜蘭縣公共圖書館 |

| 花蓮縣文化局 | 臺東縣文化處 |

|

|

'The old rule of forecasting was to make as many forecasts as possible and publicise the ones you got right. The new rule is to forecast so far in the future, no one will know you got it wrong.'

Ruchir Sharma does neither. In Breakout Nations he shows why the economic 'mania' of the twenty-first century, with its unshakeable faith in the power of emerging markets - especially China - to continue growing at the astoundingly rapid and uniform pace of the last decade, is wrong. The next economic success stories will not be where we think they are.

In this provocative new book, Sharma analyses why the basic laws of economic gravity (such as the law of large numbers, which says that the richer you are the harder it is to grow your wealth at a rapid pace) are already pulling China, Russia, Brazil and other vast emerging markets back to earth. To understand which nations will thrive and which will falter in a world reshaped by slower growth, it is time to start looking at the emerging markets as individual cases. Sharma argues that we must abandon our current obsession with global macro trends and the fad for all-embracing theories. He offers instead a more discerning, nuanced view, identifying specific factors - economic, political, social - which will make for slow or fast growth.

Spending much of his professional life travelling in these countries as Head of Emerging Markets at Morgan Stanley, Sharma is uniquely placed to present a first-hand insider's account of these new markets and the changes they are undergoing. As the years of unbelievably swift growth draw to their close, this book shows us how it is time for both investors and economists to halt their blind thrust towards an impossible future.

|