| FindBook |

有 1 項符合

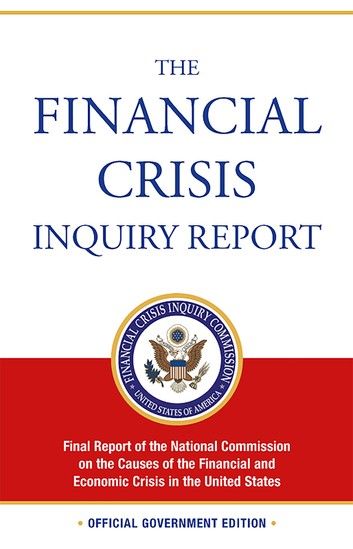

The Financial Crisis Inquiry Report: Final Report of the National Commission on the Causes of the Financial and Economic Crisis in the United States (Revised Corrected Copy)的圖書 |

|

The Financial Crisis Inquiry Report: Final Report of the National Commission on the Causes of the Financial and Economic Crisis in the United States (Revised Corrected Copy) 作者:Phil Angelides,Bill Thomas 出版社:US Independent Agencies and Commissions 出版日期:2011-04-18 語言:英文 |

| 圖書館借閱 |

| 國家圖書館 | 全國圖書書目資訊網 | 國立公共資訊圖書館 | 電子書服務平台 | MetaCat 跨館整合查詢 |

| 臺北市立圖書館 | 新北市立圖書館 | 基隆市公共圖書館 | 桃園市立圖書館 | 新竹縣公共圖書館 |

| 苗栗縣立圖書館 | 臺中市立圖書館 | 彰化縣公共圖書館 | 南投縣文化局 | 雲林縣公共圖書館 |

| 嘉義縣圖書館 | 臺南市立圖書館 | 高雄市立圖書館 | 屏東縣公共圖書館 | 宜蘭縣公共圖書館 |

| 花蓮縣文化局 | 臺東縣文化處 |

|

|

In the wake of the most significant financial crisis since the Great Depression, the President signed into law on May 20, 2009, the Fraud Enforcement and Recovery Act of 2009, creating the Financial Crisis Inquiry Commission. The Commission was established to "examine the causes, domestic and global, of the current financial and economic crisis in the United States."

The 10 members of the bi-partisan Commission, prominent private citizens with significant experience in banking, market regulation, taxation, finance, economics, housing, and consumer protection, were appointed by Congress on July 15, 2009. The Chair, Phil Angelides, and Vice Chair, Bill Thomas, were selected jointly by the House and Senate Majority and Minority Leadership.

The FCIC is charged with conducting a comprehensive examination of 22 specific and substantive areas of inquiry related to the financial crisis. Some of these areas include:

- fraud and abuse in the financial sector, including fraud and abuse towards consumers in the mortgage sector;

- Federal and State financial regulators, including the extent to which they enforced, or failed to enforce statutory, regulatory, or supervisory requirements;

- the global imbalance of savings, international capital flows, and fiscal imbalances of various governments;

- monetary policy and the availability and terms of credit;

- accounting practices, including, mark-to-market and fair value rules, and treatment of off-balance sheet vehicles;

- tax treatment of financial products and investments;

- credit rating agencies in the financial system, including, reliance on credit ratings by financial institutions and Federal financial regulators, the use of credit ratings in financial regulation, and the use of credit ratings in the securitization markets;

- lending practices and securitization, including the originate-to-distribute model for extending credit and transferring risk;

- and more

The Commission is called upon to examine the causes of major financial institutions which failed, or were likely to have failed, had they not received exceptional government assistance.

In its work, the Commission is authorized to hold hearings; issue subpoenas either for witness testimony or documents; and refer to the Attorney General or the appropriate state Attorney General any person who may have violated U.S. law in relation to the financial crisis.

|