| FindBook |

有 1 項符合

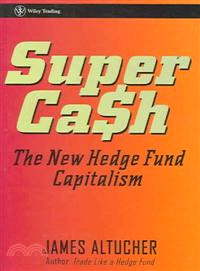

SUPER CASH THE NEW HEDGE FUND CAPITALISM的圖書 |

|

SUPER CASH THE NEW HEDGE FUND CAPITALISM 作者:James Altucher 出版社:JOHN WILEY & SONS,INC. 出版日期:2006-02-22 規格: / 精裝 / 224頁 |

| 圖書館借閱 |

| 國家圖書館 | 全國圖書書目資訊網 | 國立公共資訊圖書館 | 電子書服務平台 | MetaCat 跨館整合查詢 |

| 臺北市立圖書館 | 新北市立圖書館 | 基隆市公共圖書館 | 桃園市立圖書館 | 新竹縣公共圖書館 |

| 苗栗縣立圖書館 | 臺中市立圖書館 | 彰化縣公共圖書館 | 南投縣文化局 | 雲林縣公共圖書館 |

| 嘉義縣圖書館 | 臺南市立圖書館 | 高雄市立圖書館 | 屏東縣公共圖書館 | 宜蘭縣公共圖書館 |

| 花蓮縣文化局 | 臺東縣文化處 |

|

|

- 圖書簡介

"James Altucher is scary smart, and also a font of great and original ideas. So it's no surprise that SuperCa$h is so much fun to read and so devilishly informative. It is equally full of 'holy cow!' moments and 'why-didn't-I-think-of-that?' moments. A true keeper." —Stephen J. Dubner, coauthor of Freakonomics

"Altucher describes in easy-to-understand terms the strategies used by the smartest managers in the world—those who are running the hottest hedge funds—to show how they are making money today. SuperCa$h is a great primer for those who are looking to trade like the pros. And it helps that Altucher writes in a clear and fun style!" —John Mauldin, President of Millennium Wave Advisors, LLC, and author of Bull's Eye Investing

As hedge funds have become more mainstream, some of their strategies are less capable of producing extraordinary returns. In response, hedge fund managers and other sophisticated investors have found new ways to turn cash into supercash. Examine these new ways with hedge fund manager James Altucher and supersize your returns. - 作者簡介

JAMES ALTUCHER is a partner at the hedge fund firm Formula Capital. He writes for TheStreet.com and the Financial Times and has been a periodic guest on CNBC's Kudlow & Cramer. Previously, he was a partner with the technology venture capital firm 212 Ventures and was CEO and founder of Vaultus, a wireless and software company. He holds a BA in computer science from Cornell and attended graduate school for computer science at Carnegie Mellon University. Altucher is also the author of Trade Like a Hedge Fund and Trade Like Warren Buffett, both published by Wiley.

- 目次

Chapter 1. Hedge Funds are the New Banks.

Chapter 2. Activism.

Chapter 3. Buying Delinquent Charge Card Debt.

Chapter 4. Everything You Wanted to Know About PIPES but Were Afraid to Ask.

Chapter 5. The New New IPO.

Chapter 6. Trade Like a Billionaire.

Chapter 7. Closed End Fund Arbitrage.

Chapter 8. ShortSelling.

Chapter 9. The Finer Things in Life.

Chapter 10. Trend vs. Countertrend.

Chapter 11. The Myth of the Index or "ETFS: Active or Passive?"

Chapter 12. Watch Out!

Chapter 13. So You Want to Start a Hedge Fund?

Chapter 14. Classic Investment Reading & New Media Resources.

Chapter 15. Where to Find the Data?

Index.

|