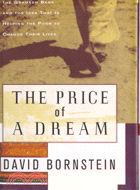

圖書簡介One afternoon in 1976 an economics professor, taking a walk in a village in Bangladesh, met a poor woman. The woman was trying to support herself by constructing and selling bamboo stools. She earned two cents a day. When the professor asked her why her profit was so low, she explained that the only person who would lend her money to buy bamboo was the trader who purchased her final product and the price he set barely covered her costs. The instinct was to open his wallet and give her some money. Then he had another thought: Why not give her a loan?

That thought became the genesis of a remarkable institution: the Grameen ("Village") Bank. Today, the Grameen Bank is considered the most successful selfsustaining antipoverty program in the world. It has more than two million borrowers---94 percent of them women---and its approach has been replicated throughout the world, including in hundreds of locations across the United States and Canada. The Price of a Dream traces the history of the Grameen Bank and in candid, vivid prose transports the reader to one of the world's most dramatic settings for a first-hand view of how this institution is helping millions of people change their lives.

Since its independence in 1971, Bangladesh has received billions of foreign aid dollars and seen the majority of its citizens grow poorer. Against this backdrop, Muhammad Yiuws, the founder of the Grameen Bank, reversed the conventional top-down development approach. In his view, development has to begin, not end, with a country's poorest citizens. In Bangladesh, this means landless women. In two decades, Yunus has shown that miracle cures are not required to alleviate poverty; instead, poverty can he addressed through innovative institutions that demonstrate faith in and respect for poor people.

Yunus began building his bank by rejecting the age- old notion that poor people are not creditworthy because they have no collateral. If banks couldn't figure out how to deal with the poor, then they weren't "people worthy." Today, his masterful system for extending small loans for self-employment to women in thousands of villages has won praise around the globe. Heralded in publications such as The New York Times, The Wall Street Journal, and The Economist, the Grameen Bank---part "laissez-faire" and "part interventionist"---has become an inspiration to policymakers everywhere, conservatives and liberals alike. In The Price of a Dream, David Bornstein explores the ideas that underlie the Grameen Bank and, in particular, Yunus's central idea: that, by unleashing the creative power and industry of poor people, a more humane world can be built. In Yunus's words, perhaps "one day poverty can be placed in museums."

![塔木德:猶太人的致富聖經[修訂版]:1000多年來帶領猶太人快速累積財富的神祕經典 塔木德:猶太人的致富聖經[修訂版]:1000多年來帶領猶太人快速累積財富的神祕經典](https://media.taaze.tw/showLargeImage.html?sc=11100697818)