| FindBook |

有 1 項符合

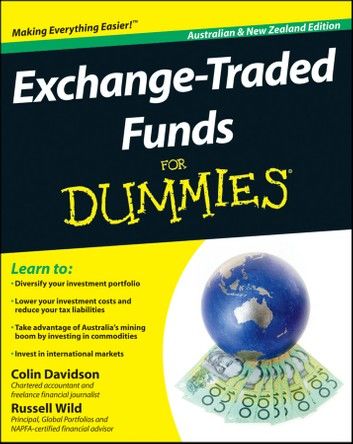

Exchange-Traded Funds For Dummies的圖書 |

|

Exchange-Traded Funds For Dummies 作者:Colin Davidson,Russell Wild 出版社:Wiley 出版日期:2011-09-26 語言:英文 |

| 圖書館借閱 |

| 國家圖書館 | 全國圖書書目資訊網 | 國立公共資訊圖書館 | 電子書服務平台 | MetaCat 跨館整合查詢 |

| 臺北市立圖書館 | 新北市立圖書館 | 基隆市公共圖書館 | 桃園市立圖書館 | 新竹縣公共圖書館 |

| 苗栗縣立圖書館 | 臺中市立圖書館 | 彰化縣公共圖書館 | 南投縣文化局 | 雲林縣公共圖書館 |

| 嘉義縣圖書館 | 臺南市立圖書館 | 高雄市立圖書館 | 屏東縣公共圖書館 | 宜蘭縣公共圖書館 |

| 花蓮縣文化局 | 臺東縣文化處 |

|

|

圖書介紹 - 資料來源:樂天KOBO 評分:

圖書名稱:Exchange-Traded Funds For Dummies

Diversify your investments with today's fastest growing financial product

Exchange-traded funds (ETFs) offer access to a range of investments in a single trade, are usually less volatile than individual stocks, cheaper than most managed funds and more tax-effective. But how do you pick the one that's right for you? This straightforward book helps you weigh up your options, build an effective portfolio and maximise your profits.

- Get to know the major players in Australia and New Zealand — find a broker, open an account and familiarise yourself with suppliers and indices

- Understand risk control and diversification — learn the importance of a diversified, lowly correlated portfolio, and how ETFs can help you achieve this

- Invest smartly in commodities and precious metals — tap into the returns offered by the Australian mining boom

- Manage small-cap, large-cap, sector and international investments — take advantage of returns in local markets and invest directly in US-listed ETFs

- Add bonds, REITs and other ETFs — secure consistent yields and add property to your investment portfolio

- Work non-ETFs into your investment mix — improve returns through careful selection of active managed funds

- Fund your retirement years — determine how much you need for retirement, and how ETFs can get you there

Open the book and find:

- Advice on choosing ETFs over options, CFDs and warrants

- Sample portfolios

- Tips on revamping your portfolio based on life changes

- How to avoid mistakes that even experienced investors make

- Forecasts for the future of ETFs in Australia and New Zealand

- A complete listing of Australian and New Zealand ETFs

- Great online resources to help you invest in ETFs

Learn to:

- Diversify your investment portfolio

- Lower your investment costs and reduce your tax liabilities

- Take advantage of Australia's mining boom by investing in commodities

- Invest in international markets

|