| FindBook |

有 1 項符合

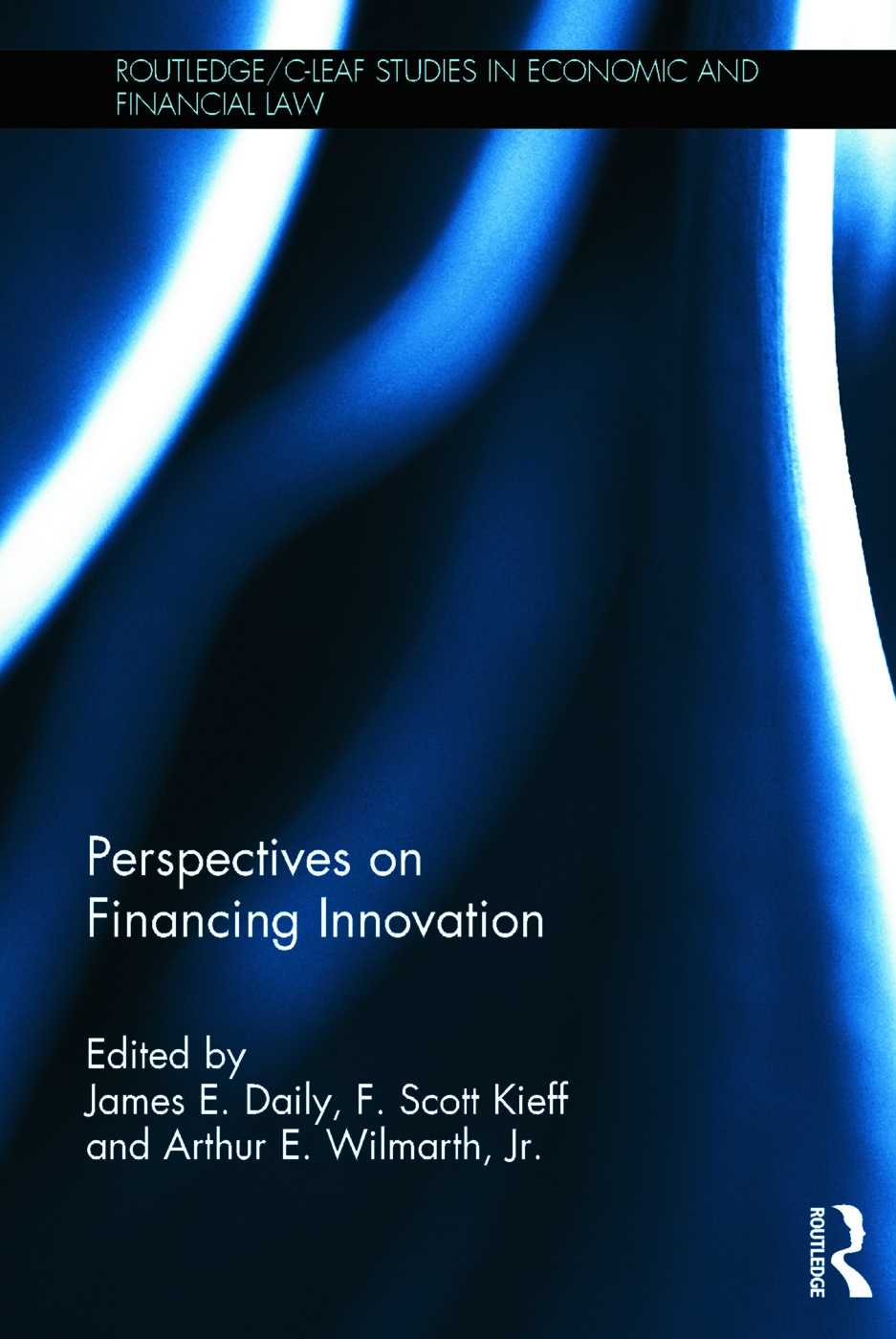

Perspectives on Financing Innovation的圖書 |

|

Perspectives on Financing Innovation 作者:Daily,James E.(EDT)/Kieff,F Scott(EDT)/Wilmarth,Arthur E.,Jr.(EDT) 出版社:Taylor & Francis 出版日期:2014-05-20 語言:英文 規格:精裝 / 16.5 x 24.1 x 2.5 cm / 普通級 |

| 圖書館借閱 |

| 國家圖書館 | 全國圖書書目資訊網 | 國立公共資訊圖書館 | 電子書服務平台 | MetaCat 跨館整合查詢 |

| 臺北市立圖書館 | 新北市立圖書館 | 基隆市公共圖書館 | 桃園市立圖書館 | 新竹縣公共圖書館 |

| 苗栗縣立圖書館 | 臺中市立圖書館 | 彰化縣公共圖書館 | 南投縣文化局 | 雲林縣公共圖書館 |

| 嘉義縣圖書館 | 臺南市立圖書館 | 高雄市立圖書館 | 屏東縣公共圖書館 | 宜蘭縣公共圖書館 |

| 花蓮縣文化局 | 臺東縣文化處 |

|

|

圖書介紹 - 資料來源:博客來 評分:

圖書名稱:Perspectives on Financing Innovation

內容簡介

"Although much has been written about innovation in the past several years, not all parts of the innovation lifecycle have been given the same treatment. This volume focuses on the important and first step of arranging financing for innovation before it is made, as well as on the feedback effect that innovation can have on finance itself. The book brings together a diverse group of leading scholars in order to address the financing of innovation. The chapters address three key areas, that of intellectualproperty, venture capital, and financial engineering in the capital markets in order to provide fresh and insightful analyses of current and future economic developments in financing innovation. Chapters on intellectual property cover topics including innovation in lawmaking, orphan business models, and the use of intellectual property to protect financial engineering innovations as well as developing intellectual property regimes in Brazil, Russia, India, and China. The book also covers the tax treatment of venture capital founders, the treatment of preferred stock by the Delaware Courts, asset-backed lending hedge funds, and corporate governance for small businesses after the Dodd-Frank financial reform bill.Perspectives on Finance and Innovation will be of interest for scholars, practitioners, and students in law, innovation, finance, and business, including market analysts, policy makers, executives, and investors"--

|