| FindBook |

有 1 項符合

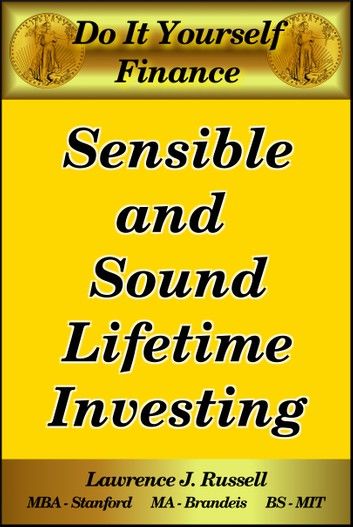

Sensible and Sound Lifetime Investing的圖書 |

|

Sensible and Sound Lifetime Investing 作者:Lawrence J. Russell 出版社:Lawrence J. Russell 出版日期:2013-11-28 語言:英文 |

| 圖書館借閱 |

| 國家圖書館 | 全國圖書書目資訊網 | 國立公共資訊圖書館 | 電子書服務平台 | MetaCat 跨館整合查詢 |

| 臺北市立圖書館 | 新北市立圖書館 | 基隆市公共圖書館 | 桃園市立圖書館 | 新竹縣公共圖書館 |

| 苗栗縣立圖書館 | 臺中市立圖書館 | 彰化縣公共圖書館 | 南投縣文化局 | 雲林縣公共圖書館 |

| 嘉義縣圖書館 | 臺南市立圖書館 | 高雄市立圖書館 | 屏東縣公共圖書館 | 宜蘭縣公共圖書館 |

| 花蓮縣文化局 | 臺東縣文化處 |

|

|

2016 Updated Edition

People can benefit greatly, when they decide to follow investment strategies that are: 1) savings-driven, 2) thoroughly diversified, 3) completely passive, 4) risk-adjusted, 5) cost-effective, and 6) tax-efficient. These factors are all interrelated. In fact, when you choose personal investment strategies with these characteristics, your financial life becomes less complicated. You can achieve better investment results, while you spend less time managing your money. When you have a simplified and durable lifetime investment strategy, you can get on with the life that you really want to live.

The author holds a BS from MIT (1975), an MA from Brandeis University (1979), and an MBA from Stanford University (1982) and is the Managing Director of an independent California Registered Investment Adviser firm.

The author's knowledge of personal financial planning and investing has been developed through:

* management of Lawrence J. Russell and Company, a California Registered Investment Adviser, where the author develops comprehensive lifetime financial and investment plans exclusively on a direct client-paid fee-only basis

* studying the finance research literature in depth for the past 10+ years to find evidence of which financial planning and investment strategies work and which do not

* design and development of VeriPlan, which is comprehensive financial planning software that supports do-it-yourself development of lifetime financial and retirement plans

* twenty-five years of prior corporate and start-up management experience in the business development, product management, financial planning, corporate development, and investment functions, including seven years with Hewlett-Packard and seven years with Sun Microsystems

|