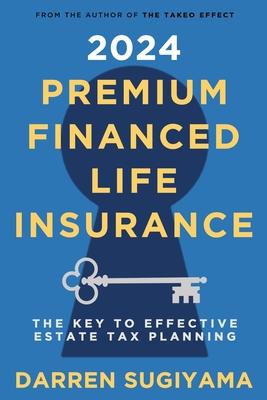

This is the Second Edition of this book - released in the beginning of 2024 - and is the updated version of Darren Sugiyama’s original book that was released in 2021. A lot has changed in the world of Premium Financed Life Insurance in the last few years including increased interest rates, a recession, the crash of crypto currency, product changes, and industry regulated restrictions put on life insurance policy illustrations. As the most transparent premium financing intermediary in the life insurance industry, Darren Sugiyama thoroughly explains different methods of premium financing he uses with different types of clients based on their unique circumstances, including several new loan platforms he developed in 2023-2024. Sugiyama also takes a deep dive into discussing how IUL policy charges and credits work, the sustainability of the 0% floor, the difference between Fixed Policy Loans and Participating Policy Loans, and IUL multiplier features. The granular details of premium financing are articulated in a way that is highly detailed, yet succinctly expressed in a way that a life insurance novice can understand. Sugiyama transparently breaks down his methods of mathematically modeling Premium Financed Life Insurance with a spirit of authenticity, consumer protection, and full disclosure. In an industry that often times paints a very opaque picture regarding how financial instruments work, Sugiyama takes a disruptive approach by dispelling the myths and uncovering the truths about how many of these sophisticated estate planning instruments are built. This is an incredibly valuable book for both clients who are considering using Premium Financed Life Insurance as an estate planning tool, as well as financial advisors and life insurance agents who are considering offering these strategies as solutions for their high net worth clients.

| FindBook |

有 1 項符合

2024 Premium Financed Life Insurance: The Key To Effective Estate Tax Planning的圖書 |

|

2024 Premium Financed Life Insurance: The Key To Effective Estate Tax Planning 作者:Sugiyama 出版社:Lulu.com 出版日期:2023-10-05 語言:英文 規格:平裝 / 152頁 / 22.86 x 15.24 x 0.84 cm / 普通級/ 初版 |

| 圖書館借閱 |

| 國家圖書館 | 全國圖書書目資訊網 | 國立公共資訊圖書館 | 電子書服務平台 | MetaCat 跨館整合查詢 |

| 臺北市立圖書館 | 新北市立圖書館 | 基隆市公共圖書館 | 桃園市立圖書館 | 新竹縣公共圖書館 |

| 苗栗縣立圖書館 | 臺中市立圖書館 | 彰化縣公共圖書館 | 南投縣文化局 | 雲林縣公共圖書館 |

| 嘉義縣圖書館 | 臺南市立圖書館 | 高雄市立圖書館 | 屏東縣公共圖書館 | 宜蘭縣公共圖書館 |

| 花蓮縣文化局 | 臺東縣文化處 |

|

|

圖書介紹 - 資料來源:博客來 評分:

圖書名稱:2024 Premium Financed Life Insurance: The Key To Effective Estate Tax Planning

|