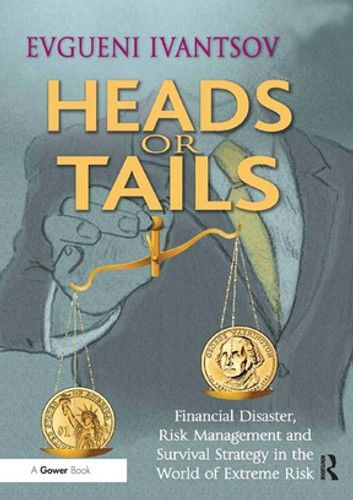

In the wake of the global financial crisis, Heads or Tails answers the question: what changes should financial institutions undergo to ensure reliable protection against extreme risks? Recent massive failures among large and respected financial institutions, clearly demonstrate that contemporary risk management and regulation fail to provide adequate responses to the challenges set by extreme risks. Dr Evgueni Ivantsov combines analysis of the nature of extreme risk (so-called tail risk), risk management practices and practical solutions to build a robust, enterprise-wide, extreme risk management framework which includes three lines of defence, ranging from strategic to tactical, designed to help address the tail risk during different stages of its development. The author also discusses: ¢ Why modern ’sophisticated’ risk management frameworks, strong capitalisation and liquidity do not prevent banks from failure in the face of systemic crisis; ¢ What it means to build an effective defence against systemic and catastrophic losses; ¢ What risk architecture should look like to ensure that extreme risk events are identified early and efficiently mitigated; ¢ How modern management practices, regulation and risk and business culture need to change to guarantee sustainability. While the context of Dr Ivantsov’s writing is financial services, the book contains an important message for specialists from any industries exposed to the extreme risks (oil/gas, energy, mining, chemical productions, transportation, etc.). Until the shortcomings of current risk management and regulation are resolved, financial services and other at risk industries will repeat the painful mistakes of the past, over and over again.