| FindBook |

有 1 項符合

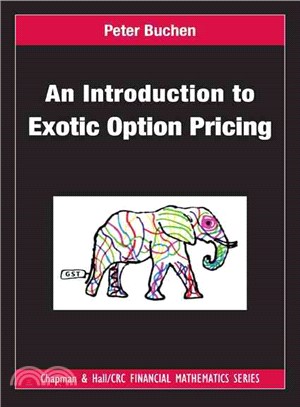

An Introduction to Exotic Option Pricing的圖書 |

|

An Introduction to Exotic Option Pricing 作者:Buchen,Peter 出版社:Taylor & Francis 出版日期:2012-02-03 語言:英文 規格:15.2 x 22.9 x 1.9 cm / 普通級/ 雙色印刷 |

| 圖書館借閱 |

| 國家圖書館 | 全國圖書書目資訊網 | 國立公共資訊圖書館 | 電子書服務平台 | MetaCat 跨館整合查詢 |

| 臺北市立圖書館 | 新北市立圖書館 | 基隆市公共圖書館 | 桃園市立圖書館 | 新竹縣公共圖書館 |

| 苗栗縣立圖書館 | 臺中市立圖書館 | 彰化縣公共圖書館 | 南投縣文化局 | 雲林縣公共圖書館 |

| 嘉義縣圖書館 | 臺南市立圖書館 | 高雄市立圖書館 | 屏東縣公共圖書館 | 宜蘭縣公共圖書館 |

| 花蓮縣文化局 | 臺東縣文化處 |

|

|

- 圖書簡介

Fully derives every price formula for the exotic options

Develops special pricing techniques based on the no-arbitrage principle

Contains a significant amount of original, previously unpublished material, such as the use of log-volutions and Mellin transforms to solve the Black?choles PDE

Demystifies many esoteric issues underpinning the mathematical treatment of the subject

Includes challenging problems at the end of each chapter to illustrate the special pricing techniques

Solutions manual available with qualifying course adoption

In an easy-to-understand, nontechnical yet mathematically elegant manner, An Introduction to Exotic Option Pricing shows how to price exotic options, including complex ones, without performing complicated integrations or formally solving partial differential equations (PDEs). The author incorporates much of his own unpublished work, including ideas and techniques new to the general quantitative finance community.

The first part of the text presents the necessary financial, mathematical, and statistical background, covering both standard and specialized topics. Using no-arbitrage concepts, the Black?choles model, and the fundamental theorem of asset pricing, the author develops such specialized methods as the principle of static replication, the Gaussian shift theorem, and the method of images. A key feature is the application of the Gaussian shift theorem and its multivariate extension to price exotic options without needing a single integration.

The second part focuses on applications to exotic option pricing, including dual-expiry, multi-asset rainbow, barrier, lookback, and Asian options. Pushing Black?choles option pricing to its limits, the author introduces a powerful formula for pricing a class of multi-asset, multiperiod derivatives. He gives full details of the calculations involved in pricing all of the exotic options.

Taking an applied mathematics approach, this book illustrates how to use straightforward techniques to price a wide range of exotic options within the Black?choles framework. These methods can even be used as control variates in a Monte Carlo simulation of a stochastic volatility model. - 作者簡介

Peter Buchen is an Associate Professor of Finance at the University of Sydney Business School. Dr. Buchen is co-founder of the Sydney Financial Mathematics Workshop, has authored many publications in financial mathematics, and has taught courses in quantitative finance and derivative securities. His research focuses on mathematical methods for valuing exotic options.

- 目次

TECHNICAL BACKGROUND

Financial Preliminaries

European Derivative Securities

Exotic Options

Binary Options

No-Arbitrage

Pricing Methods

The Black?choles PDE Method

Derivation of Black?choles PDE

Meaning of the Black?choles PDE

The Fundamental Theorem of Asset Pricing

The EMM Pricing Method

Black?choles and the FTAP

Effect of Dividends

Mathematical Preliminaries

Probability Spaces

Brownian Motion

Stochastic Des

Stochastic Integrals

It繫? Lemma

Martingales

Feynman-Kac Formula

Girsanov? Theorem

Time Varying Parameters

The Black?choles PDE

The BS Green? Function

Log-Volutions

Gaussian Random Variables

Univariate Gaussian Random Variables

Gaussian Shift Theorem

Rescaled Gaussians

Gaussian Moments

Central Limit Theorem

Log-Normal Distribution

Bivariate Normal

Multivariate Gaussian Statistics

Multivariate Gaussian Shift Theorem

Multivariate It繫? Lemma and BS-PDE

Linear Transformations of Gaussian RVs

APPLICATIONS TO EXOTIC OPTION PRICING

Simple Exotic Options

First-Order Binaries

BS-Prices for First-Order Asset and Bond Binaries

Parity Relation

European Calls and Puts

Gap and Q-Options

Capped Calls and Puts

Range Forward Contracts

Turbo Binary

The Log-Contract

Pay-at-Expiry and Money-Back Options

Corporate Bonds

Binomial Trees

Options on a Traded Account

Dual Expiry Options

Forward Start Calls and Puts

Second-Order Binaries

Second-Order Asset and Bond Binaries

Second-Order Q-Options

Compound Options

Chooser Options

Reset Options

Simple Cliquet Option

Two-Asset Rainbow Options

Two-Asset Binaries

The Exchange Option

Options on the Minimum/Maximum of Two Assets

Product and Quotient Options

ICIAM Option Competition

Executive Stock Option

Barrier Options

Introduction

Method of Images

Barrier Parity Relations

Equivalent Payoffs for Barrier Options

Call and Put Barrier Options

Barrier Option Rebates

Barrier Option Extensions

Binomial Model for Barrier Options

Partial Time Barrier Options

Double Barriers

Sequential Barrier Options

Compound Barrier Options

Outside-Barrier Options

Reflecting Barriers

Lookback Options

Introduction

Equivalent Payoffs for Lookback Options

The Generic Lookback Options m(x, y, t) and M(x, z, t)

The Standard Lookback Calls and Puts

Partial Price Lookback Options

Partial Time Lookback Options

Extreme Spread Options

Look-Barrier Options

Asian Options

Introduction

Pricing Framework

Geometric Mean Asian Options

FTAP Method for GM Asian Options

PDE Method for GM Asian Options

Discrete GM Asian Options

Exotic Multi-Options

Introduction

Matrix and Vector Notation

The M-Binary Payoff

Valuation of the M-Binary

Previous Results Revisited

Multi-Asset, One-Period Asset and Bond Binaries

Quality Options

Compound Exchange Option

Multi-Asset Barrier Options

References

Index

A Summary and Exercises appear at the end of each chapter.

|