| FindBook |

有 1 項符合

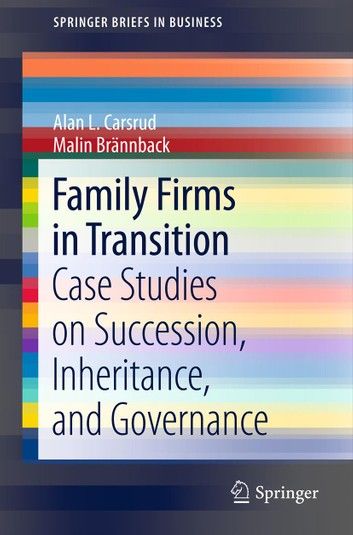

Family Firms in Transition的圖書 |

|

Family Firms in Transition 作者:Alan L. Carsrud,Malin Brännback 出版社:Springer New York 出版日期:2011-09-15 語言:英文 |

| 圖書選購 |

| 型式 | 價格 | 供應商 | 所屬目錄 | 電子書 |

$ 1411 |

企業家精神與小型企業 |

|---|

| 圖書館借閱 |

| 國家圖書館 | 全國圖書書目資訊網 | 國立公共資訊圖書館 | 電子書服務平台 | MetaCat 跨館整合查詢 |

| 臺北市立圖書館 | 新北市立圖書館 | 基隆市公共圖書館 | 桃園市立圖書館 | 新竹縣公共圖書館 |

| 苗栗縣立圖書館 | 臺中市立圖書館 | 彰化縣公共圖書館 | 南投縣文化局 | 雲林縣公共圖書館 |

| 嘉義縣圖書館 | 臺南市立圖書館 | 高雄市立圖書館 | 屏東縣公共圖書館 | 宜蘭縣公共圖書館 |

| 花蓮縣文化局 | 臺東縣文化處 |

|

|

Many of the challenges faced by family-owned businesses develop after the firm has reached a stage of maturity, when the first generation is faced with issues concerning the role of their children in the business and the long-term future of the enterprise. This collection of case studies from around the world demonstrates how governance of both the business and the family (or lack thereof) impacts succession of leadership in the firm and the inheritance of ownership and wealth.

It is the role of governance and how it impacts both family and firm that link these family business cases together with succession and inheritance. These topics have been clustered together because the social systems of the family and the management system of the firm have significant impacts on the success, or failure, of succession plans. All the planning in the world for succession and inheritance will not succeed if the firm does not have a well established and functional governance system. Likewise, if the family does not understand its role in the governance of the firm and the mechanisms for making sound decisions, succession choices may not be accepted by family members. Most family firms fail because of succession issues, not economic ones.

This volume features nine in-depth cases of family-owned business from a variety of industries to illuminate the dynamics of governance, succession, and inheritance. Each case illustrates the complexity of issues and, through interactive exercises and questions, offers readers approaches to solutions, which may include less-than-optimal compromises or even selling the business as the only viable option. The examples and insights will prove valuable for students and members of entrepreneurial and family-owned firms, as well as consultants, investors, and other professional advisors.

|