| FindBook |

有 1 項符合

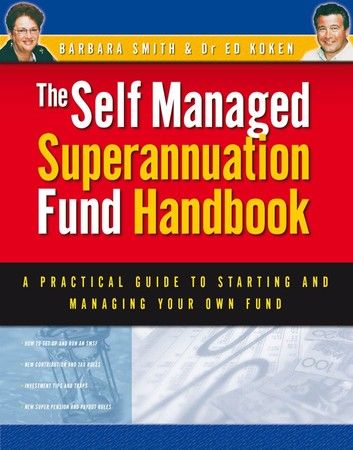

Self Managed Superannuation Fund Handbook的圖書 |

|

Self Managed Superannuation Fund Handbook 作者:Barbara Smith 出版社:Wiley 出版日期:2012-01-24 語言:英文 |

| 圖書館借閱 |

| 國家圖書館 | 全國圖書書目資訊網 | 國立公共資訊圖書館 | 電子書服務平台 | MetaCat 跨館整合查詢 |

| 臺北市立圖書館 | 新北市立圖書館 | 基隆市公共圖書館 | 桃園市立圖書館 | 新竹縣公共圖書館 |

| 苗栗縣立圖書館 | 臺中市立圖書館 | 彰化縣公共圖書館 | 南投縣文化局 | 雲林縣公共圖書館 |

| 嘉義縣圖書館 | 臺南市立圖書館 | 高雄市立圖書館 | 屏東縣公共圖書館 | 宜蘭縣公共圖書館 |

| 花蓮縣文化局 | 臺東縣文化處 |

|

|

圖書介紹 - 資料來源:樂天KOBO 評分:

圖書名稱:Self Managed Superannuation Fund Handbook

In The Self Managed Superannuation Fund Handbook, tax and superannuation specialists Barbara Smith and Dr Ed Koken show you how to take advantage of the simplified do-it-yourself superannuation and pension rules, and how to get the best out of your investments in the most tax-friendly way. This practical handbook covers:

- why you should set up and run your own fund

- investment options and strategies

- taxation tips and traps in running your fund

- accessing your retirement savings as pension

This book is full of information for investors setting up or already running an SMSF, and professionals who provide superannuation and retirement planning advice to clients with SMSFs.

|