| FindBook |

有 1 項符合

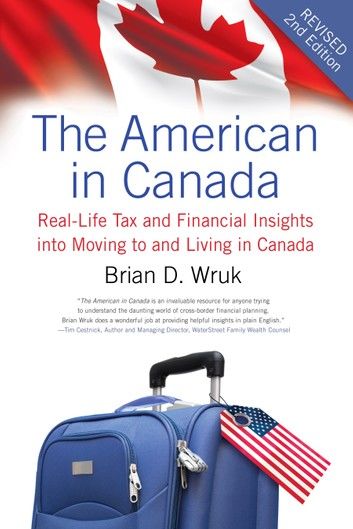

The American in Canada, Revised的圖書 |

|

The American in Canada, Revised 作者:Brian D. Wruk 出版社:ECW Press 出版日期:2015-02-01 語言:英文 |

| 圖書館借閱 |

| 國家圖書館 | 全國圖書書目資訊網 | 國立公共資訊圖書館 | 電子書服務平台 | MetaCat 跨館整合查詢 |

| 臺北市立圖書館 | 新北市立圖書館 | 基隆市公共圖書館 | 桃園市立圖書館 | 新竹縣公共圖書館 |

| 苗栗縣立圖書館 | 臺中市立圖書館 | 彰化縣公共圖書館 | 南投縣文化局 | 雲林縣公共圖書館 |

| 嘉義縣圖書館 | 臺南市立圖書館 | 高雄市立圖書館 | 屏東縣公共圖書館 | 宜蘭縣公共圖書館 |

| 花蓮縣文化局 | 臺東縣文化處 |

|

|

圖書介紹 - 資料來源:樂天KOBO 評分:

圖書名稱:The American in Canada, Revised

Hundreds of thousands of Americans are living in Canada today — and the tax issues for everyone from green card holders living in Canada to Canadians returning home from years in the U.S. are astounding and complex. In easy-to-understand language, The American in Canada focuses on the eight key areas of transition planning: immigration, customs, cash management, income tax, retirement, estate planning, risk management, and investments.

- Do you have to file tax returns with the IRS?

- What income do you have to declare, and in which country? Should you leave your IRAs and 401(k)s in the U.S.?

- What immigration avenues are available to help you move into Canada?

- Do you qualify for Canada’s socialized healthcare programs?

- What should you do with your home or rental property in the U.S.?

These questions, and many more, are answered in this essential guide for the American living in Canada.

|