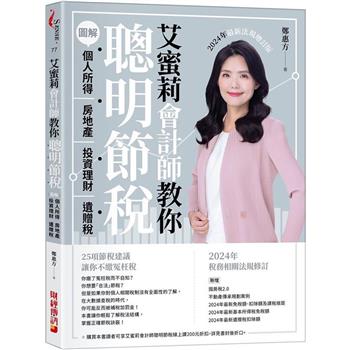

Published June 2025 - Plain English guide with dozens of examples and tax planning tips.

There have been a huge number of tax changes since the last edition was published, all covered in the latest release of this popular guide. Essential reading for those who already have a property company and those thinking about setting one up.

This unique guide tells you EVERYTHING you need to know about using a company to invest in property:

- All the expenses your company can claim, including salaries paid to you and your family, home office costs, travel costs, training and research, property repairs, furniture etc.

- A whole chapter dedicated to maximising tax relief on mortgages and other borrowings - individual landlords have their tax relief restricted, companies do not.

- How retaining profits in your company can leave you with 75% to 80% more after-tax profit to reinvest.

- Expanded guidance on how to extract money tax efficiently following recent changes to national insurance.

- A whole chapter on stamp duty land tax planning, including the recent abolition of multiple dwellings relief.

- How companies are taxed on their capital gains, including all the tax reliefs that can be claimed.

- How to set up a company and how to put existing property into a company.

- The guide is also relevant to those involved in property development and trading.

- The author, Carl Bayley FCA is a former Chairman of the Tax Faculty at the Institute of Chartered Accountants in England and Wales (ICAEW) and served as a member of the Institute’s governing council for over 20 years.