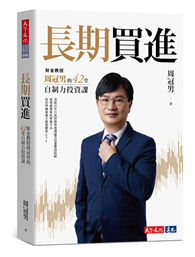

Success in the stock market is about proper decision-making. Which stocks to buy? When to buy? When to sell? Sounds simple enough. The first decision about which stocks to buy is where all the trouble begins for most people. There is an assumption that more research leads to better stock picking. Of course, where there is demand, the supply will follow. That is the definition of capitalism. Sellers of research and reports and rumors and hype for the stock you are interested in will offer plenty of windows for you to jump out of.

It seems like the stock you pick somehow is not the one that runs. It is the stock that no one thought would be the winner that runs. How to make better decisions? Is it even possible? What are the steps you need to take to start on the path of developing better decision-making skills?Brad Koteshwar, a proponent of using price/volume chart action to observe, interpret and act, introduces seven separate case studies to help illuminate the keys to proper decision-making. Each case study uses a separate individual stock, and its real-life movements and charts, and weaves a fictional short story for each stock to make a boring topic interesting and instructional at the same time.A perfect primer for the students of the stock market seeking to improve their decision-making skills.| FindBook |

有 1 項符合

The Perfect Method: How To Speculate In Stocks In A Bull Trend的圖書 |

|

The Perfect Method: How To Speculate In Stocks In A Bull Trend 作者:Koteshwar 出版社:Great Expressions Publishing 出版日期:2024-10-28 語言:英文 規格:平裝 / 220頁 / 22.86 x 15.24 x 1.52 cm / 普通級/ 初版 |

| 圖書館借閱 |

| 國家圖書館 | 全國圖書書目資訊網 | 國立公共資訊圖書館 | 電子書服務平台 | MetaCat 跨館整合查詢 |

| 臺北市立圖書館 | 新北市立圖書館 | 基隆市公共圖書館 | 桃園市立圖書館 | 新竹縣公共圖書館 |

| 苗栗縣立圖書館 | 臺中市立圖書館 | 彰化縣公共圖書館 | 南投縣文化局 | 雲林縣公共圖書館 |

| 嘉義縣圖書館 | 臺南市立圖書館 | 高雄市立圖書館 | 屏東縣公共圖書館 | 宜蘭縣公共圖書館 |

| 花蓮縣文化局 | 臺東縣文化處 |

|

|

圖書介紹 - 資料來源:博客來 評分:

圖書名稱:The Perfect Method: How To Speculate In Stocks In A Bull Trend

|