Retail Investor Behavior in the IPO market, especially in Kerala, involves understanding the complex interplay of decisions shaped by financial literacy, behavioral biases, personality traits, and risk tolerance. As India’s financial landscape evolves, retail investors face challenges in evaluating IPOs, influenced by their knowledge and inherent biases. This study explores these dynamics using primary data and various analytical tools, including Cronbach’s alpha, ANOVA, Discriminant Analysis, and Structural Equation Modeling (SEM). The findings highlight that higher financial literacy leads to more informed investment decisions, while personality traits like openness or neuroticism significantly affect IPO participation. Behavioral biases often lead investors away from optimal choices, and risk tolerance emerges as a crucial factor, with those having a higher risk appetite showing greater enthusiasm for IPOs. This research underscores the importance of understanding retail investment behavior to guide investor education, regulatory strategies, and future research, ultimately enhancing the retail investor community’s resilience in Kerala’s IPO market.

| FindBook |

有 1 項符合

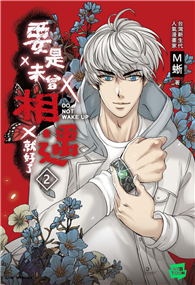

Retail Investors and IPOs: Decoding Market Behavior and Trends的圖書 |

|

Retail Investors and IPOs: Decoding Market Behavior and Trends 作者:Lukose 出版社:LAP Lambert Academic Publishing 出版日期:2024-09-02 語言:英文 規格:平裝 / 348頁 / 22.86 x 15.24 x 1.98 cm / 普通級/ 初版 |

| 圖書館借閱 |

| 國家圖書館 | 全國圖書書目資訊網 | 國立公共資訊圖書館 | 電子書服務平台 | MetaCat 跨館整合查詢 |

| 臺北市立圖書館 | 新北市立圖書館 | 基隆市公共圖書館 | 桃園市立圖書館 | 新竹縣公共圖書館 |

| 苗栗縣立圖書館 | 臺中市立圖書館 | 彰化縣公共圖書館 | 南投縣文化局 | 雲林縣公共圖書館 |

| 嘉義縣圖書館 | 臺南市立圖書館 | 高雄市立圖書館 | 屏東縣公共圖書館 | 宜蘭縣公共圖書館 |

| 花蓮縣文化局 | 臺東縣文化處 |

|

|

圖書介紹 - 資料來源:博客來 評分:

圖書名稱:Retail Investors and IPOs: Decoding Market Behavior and Trends

|