| FindBook |

有 1 項符合

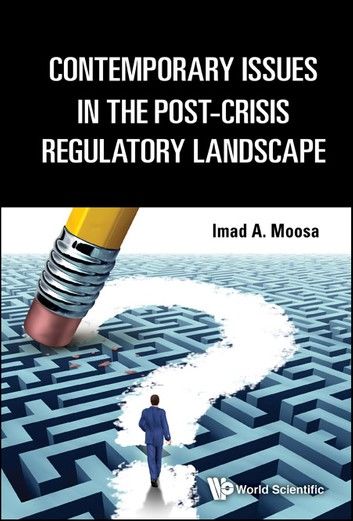

Contemporary Issues in the Post-Crisis Regulatory Landscape的圖書 |

|

Contemporary Issues In The Post-crisis Regulatory Landscape 作者:Imad A Moosa 出版社:World Scientific Publishing Company 出版日期:2016-10-14 語言:英文 |

| 圖書館借閱 |

| 國家圖書館 | 全國圖書書目資訊網 | 國立公共資訊圖書館 | 電子書服務平台 | MetaCat 跨館整合查詢 |

| 臺北市立圖書館 | 新北市立圖書館 | 基隆市公共圖書館 | 桃園市立圖書館 | 新竹縣公共圖書館 |

| 苗栗縣立圖書館 | 臺中市立圖書館 | 彰化縣公共圖書館 | 南投縣文化局 | 雲林縣公共圖書館 |

| 嘉義縣圖書館 | 臺南市立圖書館 | 高雄市立圖書館 | 屏東縣公共圖書館 | 宜蘭縣公共圖書館 |

| 花蓮縣文化局 | 臺東縣文化處 |

|

|

The book deals with contemporary issues in financial regulation, given the post-crisis regulatory landscape. The major idea put forward is that rampant corruption and fraud in the financial sector provide the main justification for financial regulation. Specific issues that are dealt with include the proposition that the Efficient Market Hypothesis was both a cause and a casualty of the global financial crisis. The book also examines the regulation of remuneration in the financial sector, credit rating agencies and shadow banking. Also considered is financial reform in Iceland and the proposal to move away from fractional reserve banking to a system of sovereign money. A macroeconomic/regulatory issue that is also considered is quantitative easing and the resulting environment of ultra-low interest rates.

Contents:

- The Post-Crisis Regulatory Landscape: An Overview

- Regulatory Issues in the Aftermath of the Crisis

- Financial Regulation as a Response to Corruption and Fraud

- The War on Regulation

- The Efficient Market Hypothesis as a Weapon of Mass Destruction

- The Regulation of Remuneration in the Financial Sector

- The Regulation of Shadow Banking

- The Regulation of Credit Rating Agencies

- The Regulatory Implications of Quantitative Easing

- Financial Reform in Iceland

- The Way Forward

Readership: Students and researchers who would like to have an indepth understanding of the current issues in financial regulation.

|