| FindBook |

有 1 項符合

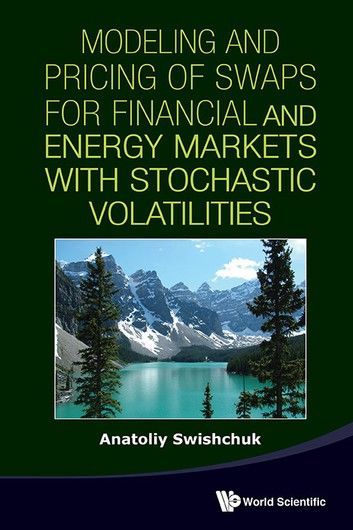

Modeling and Pricing of Swaps for Financial and Energy Markets with Stochastic Volatilities的圖書 |

|

Modeling And Pricing Of Swaps For Financial And Energy Markets With Stochastic Volatilities 作者:Anatoliy Swishchuk 出版社:World Scientific Publishing Company 出版日期:2013-06-03 語言:英文 |

| 圖書館借閱 |

| 國家圖書館 | 全國圖書書目資訊網 | 國立公共資訊圖書館 | 電子書服務平台 | MetaCat 跨館整合查詢 |

| 臺北市立圖書館 | 新北市立圖書館 | 基隆市公共圖書館 | 桃園市立圖書館 | 新竹縣公共圖書館 |

| 苗栗縣立圖書館 | 臺中市立圖書館 | 彰化縣公共圖書館 | 南投縣文化局 | 雲林縣公共圖書館 |

| 嘉義縣圖書館 | 臺南市立圖書館 | 高雄市立圖書館 | 屏東縣公共圖書館 | 宜蘭縣公共圖書館 |

| 花蓮縣文化局 | 臺東縣文化處 |

|

|

Modeling and Pricing of Swaps for Financial and Energy Markets with Stochastic Volatilities is devoted to the modeling and pricing of various kinds of swaps, such as those for variance, volatility, covariance, correlation, for financial and energy markets with different stochastic volatilities, which include CIR process, regime-switching, delayed, mean-reverting, multi-factor, fractional, Levy-based, semi-Markov and COGARCH(1,1). One of the main methods used in this book is change of time method. The book outlines how the change of time method works for different kinds of models and problems arising in financial and energy markets and the associated problems in modeling and pricing of a variety of swaps. The book also contains a study of a new model, the delayed Heston model, which improves the volatility surface fitting as compared with the classical Heston model. The author calculates variance and volatility swaps for this model and provides hedging techniques. The book considers content on the pricing of variance and volatility swaps and option pricing formula for mean-reverting models in energy markets. Some topics such as forward and futures in energy markets priced by multi-factor Levy models and generalization of Black-76 formula with Markov-modulated volatility are part of the book as well, and it includes many numerical examples such as S&P60 Canada Index, S&P500 Index and AECO Natural Gas Index.

Contents:

- Stochastic Volatility

- Stochastic Volatility Models

- Swaps

- Change of Time Methods

- Black-Scholes Formula by Change of Time Method

- Modeling and Pricing of Swaps for Heston Model

- Modeling and Pricing of Variance Swaps for Stochastic Volatilities with Delay

- Modeling and Pricing of Variance Swaps for Multi-Factor Stochastic Volatilities with Delay

- Pricing Variance Swaps for Stochastic Volatilities with Delay and Jumps

- Variance Swap for Local Lévy-Based Stochastic Volatility with Delay

- Delayed Heston Model: Improvement of the Volatility Surface Fitting

- Pricing and Hedging of Volatility Swap in the Delayed Heston Model

- Pricing of Variance and Volatility Swaps with Semi-Markov Volatilities

- Covariance and Correlation Swaps for Markov-Modulated Volatilities

- Volatility and Variance Swaps for the COGARCH(1,1) Model

- Variance and Volatility Swaps for Volatilities Driven by Fractional Brownian Motion

- Variance and Volatility Swaps in Energy Markets

- Explicit Option Pricing Formula for a Mean-Reverting Asset in Energy Markets

- Forward and Futures in Energy Markets: Multi-Factor Lévy Models

- Generalization of Black-76 Formula: Markov-Modulated Volatility

Readership: Post-graduate level researchers and professionals with interest in the modeling and pricing of swaps for energy and financial markets.

Key Features:

- Provides coverage on topic of swaps not covered in such detail by other titles, in relation to energy and financial markets

- In particular, offers a comprehensive treatment of various types of swaps and a variety of stochastic volatility models, in relation to energy and financial markets

|