| FindBook |

有 1 項符合

Studies on Financial Markets in East Asia的圖書 |

|

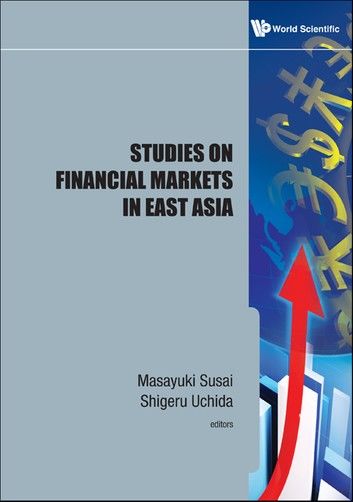

Studies On Financial Markets In East Asia 作者:Masayuki Susai,Shigeru Uchida 出版社:World Scientific Publishing Company 出版日期:2011-01-31 語言:英文 |

| 圖書館借閱 |

| 國家圖書館 | 全國圖書書目資訊網 | 國立公共資訊圖書館 | 電子書服務平台 | MetaCat 跨館整合查詢 |

| 臺北市立圖書館 | 新北市立圖書館 | 基隆市公共圖書館 | 桃園市立圖書館 | 新竹縣公共圖書館 |

| 苗栗縣立圖書館 | 臺中市立圖書館 | 彰化縣公共圖書館 | 南投縣文化局 | 雲林縣公共圖書館 |

| 嘉義縣圖書館 | 臺南市立圖書館 | 高雄市立圖書館 | 屏東縣公共圖書館 | 宜蘭縣公共圖書館 |

| 花蓮縣文化局 | 臺東縣文化處 |

|

|

This book will be an important addition to the limited number of books that discuss finance and accounting issues in East Asian countries. While presenting recent empirical studies on finance and accounting in East Asian economies, it also reveals the underlying reasons for remarkable economic growth and emerging performance of the financial markets in the East Asian countries. It introduces newly developed financial products, institutions, governance mechanism, banking policy changes and their implications in the East Asian economies, and discusses the way forward for these economies with recommendations for policy implications. It also contains suggestions for other developing countries trying to achieve rapid growth.

Contents:

- Multi Foreign Exchange Rate Relations in Turbulent Market: Lessons from Lehman Shock

- The Asymmetric Contagion from the US Stock Market Around the Subprime Crisis

- Can Monetary Policy target on Asset Price? Evidence from Chinese Real Estate Market

- Relationship Banking and Firm Profitability

- The Choice between Dividend and Share Repurchase

- Banking Relationships in East Asian Economies: Lessons for Developing Countries

- An Econometric Analysis of Japanese Government Bond Markets in the Prewar and Postwar Periods

- Hedging, IPOs and Japanese Days-of-the-Week Stock Return Patterns

- Return, Volatility and Liquidity of the JGB Futures

- Consistency of Risk Attitude and Other Investment Behavior of Japanese Fund Managers

Readership: Researchers, graduate students and academicians interested in financial markets and Asian economies.

Key Features:

- One of the few books on East Asian Economies written in English

- Covers a wide range of topics like capital market, foreign exchange market, real estate market, banking including recent ones like sub-prime crisis, Lehman shock, etc.

|