| FindBook |

|

有 1 項符合

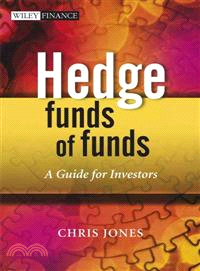

Hedge Funds Of Funds: A Guide for Investors的圖書 |

|

$ 3078 | HEDGE FUNDS OF FUNDS: A GUIDE FOR INVESTORS

作者:JONES 出版社:JOHN WILEY & SONS,LTD 出版日期:2007-11-30 規格: / 288頁  看圖書介紹 看圖書介紹

|

|

|

- 圖書簡介

Hedge Funds of Funds: A Guide for Investors is a comprehensive guide to investing in hedge funds of funds. Written by an experienced practitioner in clear, concise and jargon free language, this book gives an inside view of this often opaque area and empowers readers with the tools to get to the bottom of how hedge funds of funds really work.

Key features include:

A full description of the skill sets and facets needed in all areas of a hedge funds of funds;

A wide-ranging set of questions to ask when assessing every area of a hedge fund of funds;

Advice on every part of the process when investing in a hedge fund of funds, from short-listing through to mandate design and benchmarking;

Two comprehensive practical examples of investment reports on both a hedge fund and a hedge fund of funds;

A comprehensive analysis of recent developments in the field;

A glossary of hedge fund terminology to help the reader de-code the jargon associated with the area.

This book is essential reading for all those interested in developing depth to their understanding of how to invest in hedge funds of funds and how they, in turn, invest with hedge funds. - 作者簡介

Dr. Chris Jones, London, UK is Chief Investment Officer of Key Asset Management, one of Europe’s oldest hedge fund houses managing over $1bn in assets. He has been investing in hedge funds in a professional capacity since 1994, and previously worked in this area at Sanlam, State Street Global Advisors and Liberty Ermitage. Prior to this, he has worked in trading and asset management capacities at Société Générale and Crédit Lyonnais. Chris frequently appears in the hedge fund trade press and on CNBC commenting on hedge funds, and regularly educates pension plan trustees and other industry professionals in this area.

Chris has presented lectures, conference papers and seminars at universities in North America, Europe and Australasia and has published several papers on trading and investment strategies, risk management and hedge funds. He has a BA in Mathematics from Oxford University and a PhD in Finance from the University of Cambridge, where he has an ongoing Visiting Associate position and is an occasional Lecturer. - 目次

Preface.

Acknowledgements.

PART I: AN INTRODUCTION TO HEDGE FUNDS AND HEDGE FUNDS OF FUNDS.

1 Introduction.

1.1 About this book.

1.2 Overview.

1.3 What are hedge funds?

1.4 How do hedge funds generate absolute returns?

1.5 Who invests in hedge funds?

1.6 Where’s the catch?

1.7 What are hedge funds of funds?

1.8 The growth of hedge funds.

1.9 Conclusion.

1.10 Glossary for Chapter 1.

1.11 Summary of ideas for Chapter 1.

2 Hedge Fund Strategies.

2.1 Overview.

2.2 Equity Long/Short.

2.3 Event Driven and Distressed investing.

2.4 Relative Value and Arbitrage Strategies.

2.5 Trading and Macro strategies.

2.6 Summary.

2.7 Glossary for Chapter 2.

2.8 Summary of ideas for Chapter 2.

3 The Benefits and Risks of Investing in Hedge Funds.

3.1 Overview.

3.2 The benefits of investing with hedge funds.

3.3 The rationale for hedge fund returns.

3.4 Hedge fund strategies and the nature of hedge fund returns.

3.5 The downsides of investing in hedge funds.

3.6 Summary.

3.7 Glossary for Chapter 3.

3.8 Summary of ideas for Chapter 3.

4 Investing in Hedge Funds Through a Hedge Fund of Funds.

4.1 Overview.

4.2 What do hedge funds of funds do?

4.3 The role of the hedge fund of funds manager.

4.4 Hedge fund of funds vs direct investment: Benefits and downsides.

4.5 Hedge fund of funds vs multi-strategy hedge funds.

4.6 Summary and conclusion of Part I.

4.7 Glossary for Chapter 4.

4.8 Summary of ideas for Chapter 4.

PART II: HEDGE FUNDS OF FUNDS IN ACTION.

5 Core Functions and Capabilities of Hedge Funds of Funds.

5.1 Overview.

5.2 Hedge fund of funds core functions.

5.3 Hedge funds of funds core personnel.

5.4 Summary.

5.5 Summary of ideas for Chapter 5.

6 The Hedge Funds of Funds Investment Process.

6.1 Overview.

6.2 Strategy analysis and allocation.

6.3 Sourcing and capacity negotiation.

6.4 Quantitative analysis and filtering.

6.5 Qualitative analysis.

6.6 Referencing and operational due diligence.

6.7 Portfolio construction for hedge funds of funds.

6.8 Critical analysis and the decision process.

6.9 Summary.

6.10 Summary of ideas for Chapter 6.

7 The Hedge Funds of Funds Risk, Monitoring and Portfolio Management Processes.

7.1 Overview – Risk and hedge funds.

7.2 Risk management methodology within hedge funds.

7.3 Assessing the risk management process of hedge funds.

7.4 Risk management within hedge funds of funds.

7.5 Ongoing monitoring and portfolio management.

7.6 Summary.

7.7 Summary of ideas for Chapter 7.

8 An Example of a Hedge Fund of Funds’ Investment Report.

8.1 Overview.

8.2 The Report.

8.3 Summary.

8.4 Summary of ideas for Chapter 8.

PART III: EVALUATING, SELECTING AND INVESTING IN HEDGE FUNDS OF FUNDS.

9 Assessing Hedge Funds of Funds.

9.1 Overview.

9.2 Investment process.

9.3 Risk management, portfolio management and monitoring.

9.4 Track record analysis.

9.5 The hedge fund of funds team.

9.6 Operational aspects of hedge funds of funds.

9.7 Summary.

9.8 Summary of ideas for Chapter 9.

10 Designing the Investment Process.

10.1 Overview.

10.2 Designing the selection and investment processes.

10.3 Some tips for meeting with hedge funds of funds.

10.4 Summary.

10.5 Summary of ideas for Chapter 10.

11 Investment and Monitoring.

11.1 Overview.

11.2 Investing in a hedge fund of funds.

11.3 Benchmarking and monitoring.

11.4 Summary.

11.5 Summary of ideas for Chapter 11.

12 A Sample Hedge Fund of Funds Investment Report.

12.1 Overview.

12.2 The Report.

12.3 Summary.

12.4 Summary of ideas for Chapter 12.

PART IV: FURTHER TOPICS IN HEDGE AND FUNDS OF FUNDS.

13 Structured Products, Portable Alpha and Liability Driven Investment.

13.1 Overview of Part IV.

13.2 Chapter overview.

13.3 Structured products.

13.4 Portable alpha.

13.5 Liability driven investments.

13.6 Summary.

13.7 Summary of ideas for Chapter 13.

14 Hedge Fund Indices and Replication.

14.1 Overview.

14.2 Hedge fund indices.

14.3 Hedge fund replication.

14.4 Summary.

14.5 Summary of ideas for Chapter 14.

15 The Leading Edge: Recent Innovations in the Hedge Fund of Funds World.

15.1 Overview.

15.2 Hedge fund returns.

15.3 Hedge fund indexation and replication.

15.4 Hedge fund structures and structured products.

15.5 Hedge fund risk.

15.6 Other hedge fund work.

15.7 Summary.

15.8 Summary of ideas for Chapter 15.

16 Conclusion.

References.

Glossary.

Index.

|