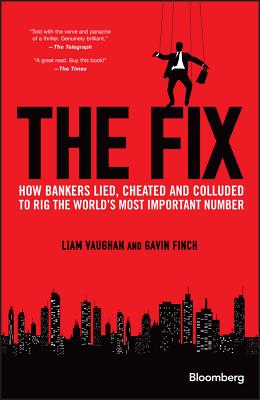

The book will be a definitive account of the Libor scandal, in which the world’s biggest banks colluded to rig the price of money for their own benefit and, in doing so, altered trillions of dollars of contracts from mortgages and derivatives to the interest paid on the U.S. government’s TARP loans.

However, the book will not simply be a temporal narrative of the scandal. The authors intend to discuss the implications of the Libor scandal on other benchmarking systems, discuss internal challenges for banks as well as regulators who are currently dealing with the fall-out and also discuss the potential reforms necessary to really repair and renew the system.| FindBook |

|

有 1 項符合

John S. Vaughan的圖書 |

|

$ 948 | The Fix: How Bankers Lied, Cheated and Colluded to Rig the World’s Most Important Number

作者:Vaughan,Liam/Finch,Gavin 出版社:John Wiley & Sons Inc 出版日期:2017-01-24 語言:英文 規格:精裝 / 15.9 x 23.5 x 2.5 cm / 普通級  看圖書介紹 看圖書介紹

|

|

|

圖書介紹 - 資料來源:博客來 評分:

圖書名稱:The Fix: How Bankers Lied, Cheated and Colluded to Rig the World’s Most Important Number

|