| FindBook |

|

有 13 項符合

Weert的圖書,這是第 2 頁 |

|

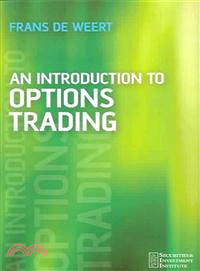

$ 1575 | AN INTRODUCTION TO OPTIONS TRADING

作者:FRANS DE WEERT 出版社:JOHN WILEY & SONS,LTD 出版日期:2006-07-14 規格: / 176頁  看圖書介紹 看圖書介紹

|

|

|

- 圖書簡介

Explaining the theory and practice of options from scratch, this book focuses on the practical side of options trading, and deals with hedging of options and how options traders earn money by doing so. Common terms in option theory are explained and readers are shown how they relate to profit. The book gives the necessary tools to deal with options in practice and it includes mathematical formulae to lift explanations from a superficial level. Throughout the book real-life examples will illustrate why investors use option structures to satisfy their needs.

- 作者簡介

Frans de Weert is mathematician by training who is currently working as an equity derivatives trader at Barclays Capital, New York. After obtaining his masters in Mathematics, specializing in probability theory and financial mathematics at the University of Utrecht, he went on to do a research degree, M.Phil, in probability theory at the University of Manchester.

After his academic career he started working as trader for Barclays Capital in London. In this role he gained experience in trading many different derivative products on European and American equities. After two and half years in London, he moved to New York to start trading derivatives on both Latin American as well as US underlyings. Frans de Weert lives in New York city. - 目次

Preface.

Acknowledgements.

Introduction

1. OPTIONS.

1.1 Examples.

1.2 American versus European options.

1.3 Terminology.

1.4 Early exercise of American options.

1.5 Payoffs.

1.6 Put-call Parity.

2. THE BLACK-SCHOLES FORMULA.

2.1 Volatility and the Black-Scholes formula.

2.2 Interest rate and the Black-Scholes formula.

2.3 Pricing American options.

3. DIVIDENDS AND THEIR EFFECT ON OPTIONS.

3.1 Forwards.

3.2 Pricing of stock options including dividends.

3.3 Pricing options in terms of the forward.

3.4 Dividend risk for options.

3.5 Synthetics.

4. IMPLIED VOLATILITY.

4.1 Example.

4.2 Strategy and implied volatility.

5. DELTA.

5.1 Delta hedging.

5.2 The most dividend sensitive options.

5.3 Exercise-ready American calls in dividend paying stocks.

6. THREE OTHER GREEKS.

6.1 Gamma.

6.2 Theta.

6.3 Vega.

7. THE PROFIT OF OPTION TRADERS.

7.1 Dynamic hedging of a long call option.

7.2 Dynamic hedging of a short call option.

7.3 Profit formula for dynamic formula.

7.4 The relationship between dynamic hedging and q.

7.5 The relationship between dynamic hedging and q when the interest rate is Strictly positive.

7.6 Conclusion.

8. OPTION GREEKS IN PRACTICE.

8.1 Interaction between Gamma and Vega.

8.2 The importance of the direction of the underlying share to the option Greeks.

8.3 Pin risk for short dated options.

8.4 The riskiest options to go short.

9. SKEW.

19.1 What is skew?

9.2 Reason for skew.

9.3 Reason for higher volatilities in falling markets.

10. SEVERAL OPTION STRATEGIES.

10.1 Call spread.

10.2 Put spread.

10.3 Collar.

10.4 Straddle.

10.5 Strangle.

11. DIFFERENT OPTION STRATEGIES AND WHY INVESTORS EXECUTE THEM.

11.1 The portfolio manager's approach to options.

11.2 Options and Corporates with cross-holdings.

11.3 Options in case of a takeover.

11.4 Risk reversals for insurance companies.

11.5 Pre-paid forwards.

11.6 Employee incentive schemes.

11.7 Share Buy-backs.

12. TWO EXOTIC OPTIONS.

12.1 The quanto option.

12.2 The composite option.

13. REPO.

13.1 A repo example.

13.2 Repo in case of a takeover.

13.3 Repo and its effect on options.

13.4 Takeover in cash and its effect on the forward.

Appendix A: Probability that an option expires in the money.

Appendix B: Variance of a composite option.

Bibliography.

Index.

|

![塔木德:猶太人的致富聖經[修訂版]:1000多年來帶領猶太人快速累積財富的神祕經典 塔木德:猶太人的致富聖經[修訂版]:1000多年來帶領猶太人快速累積財富的神祕經典](https://media.taaze.tw/showLargeImage.html?sc=11100697818)