In today’s fast-paced and dynamic business environment, the only constant is change. Nowhere is this truer than in the realm of finance and accounting, and more specifically, accounts payable. Traditional processes and practices are rapidly evolving by advances in technology, automation, new and ever-innovative frauds, evolving regulations, and shifting market dynamics. One area that stands at the forefront of this evolution is the accounts payable function. As the financial heart of an organization, accounts payable plays a pivotal role in managing cash flow, vendor relationships, avoiding fraud, and financial stability.

The significance of accounts payable cannot be overstated. Tomorrow’s accounts payable department will look very different from today’s. The very basic processes are changing, invoices are no longer largely paper, payments are no longer largely being made by paper checks and sadly, fraud is evolving at a rate faster than anything else.

Table of Contents- Introduction

- Chapter 1: The AP Department

- Chapter 2: The Process

- Chapter 3: Payments

- Chapter 4: Fraud

- Chapter 5: Evolving Best Practices

- Chapter 6: Planning for the Future

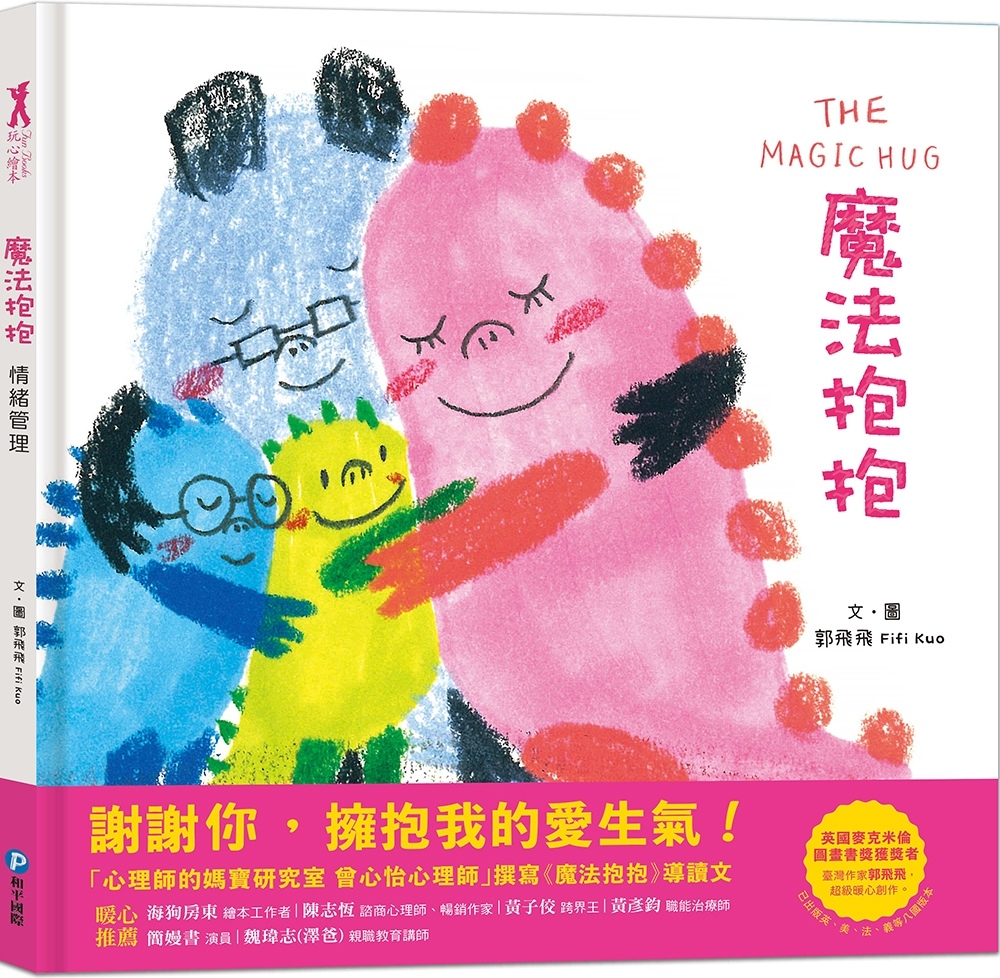

看圖書介紹

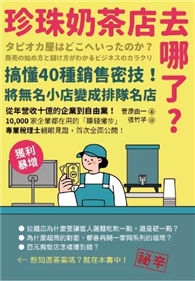

看圖書介紹