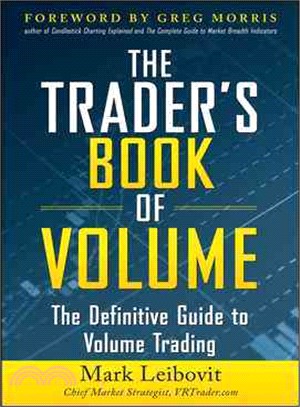

Learn how to read the “language” of volume!

Volume does more than measure the number of shares changing hands between market participants. When you learn to interpret volume into trading signals, you can read the mood of the market, discover great new trading strategies, and put price changes in context.

Providing an abundance of facts and data to confirm the power of volume in forecasting price action, The Trader’s Book of Volume arms you with market-tested techniques and strategies for trading volume indicators and oscillators.

You’ll learn how to generate impressive profits from a wide array of trading volume indicators, including:

- Broad Market Volume Indicators, such as the cumulative volume index, the large block ratio, upside-downside volume, and the yo-yo indicator

- Trending Volume Indicators, such as the demand index, equivolume, intra-day intensity, the negative volume index, and normalized volume

- Mid-Frame (Term) Indicators, such as Chaikin money flow, the force index, the money flow index, and the popular Wyckoff method

- Mark's Leibovit's Flexible Timeframe Indicator, which the author has named Leibovit Volume Reversal

With The Trader’s Book of Volume as your guide, you can make this powerful trading tool a vital and profitable component of your day-to-day trading program.