| FindBook |

有 1 項符合

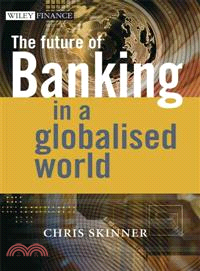

BANKING IN THE 21ST CENTURY - IN A GLOBALI的圖書 |

|

Banking In The 21St Century - In A Globalised World 作者:CHRIS SKINNER 出版社:JOHN WILEY & SONS,LTD 出版日期:2007-04-20 規格: / 精裝 / 210頁 |

| 圖書館借閱 |

| 國家圖書館 | 全國圖書書目資訊網 | 國立公共資訊圖書館 | 電子書服務平台 | MetaCat 跨館整合查詢 |

| 臺北市立圖書館 | 新北市立圖書館 | 基隆市公共圖書館 | 桃園市立圖書館 | 新竹縣公共圖書館 |

| 苗栗縣立圖書館 | 臺中市立圖書館 | 彰化縣公共圖書館 | 南投縣文化局 | 雲林縣公共圖書館 |

| 嘉義縣圖書館 | 臺南市立圖書館 | 高雄市立圖書館 | 屏東縣公共圖書館 | 宜蘭縣公共圖書館 |

| 花蓮縣文化局 | 臺東縣文化處 |

|

|

- 圖書簡介

The world of banking is changing dramatically as a result of regulation, technology and society. New developments in the past three years include advances in regulatory change, the impact of China and India; from the latest technologies to impact bank services, to the latest experiments with a cashless society.

The Future of Banking in a Globalised World provides an entertaining yet informative look at the world of banking and chronicles the radical changes that have occurred in the industry over the past three years. Renowned analyst and international speaker, Chris Skinner assesses the trends that have occurred during the past three years and looks at predictions for the future of banking.

Issues discussed include:

• The impact of emerging markets such as China and India

• Regulatory changes including Europe’s Financial Services Action Plan, MiFID, SEPA, as well as the impact of Basel II and Sarbanes-Oxley

• The latest technologies to impact Bank services from algorithmic trading through Web 2.0

• The displacement of Cash and Cards through Contactless, Mobile and Biometric Payments - 作者簡介

CHRIS SKINNER is well-known for his regular columns on Finextra.com and in the Banker magazine, as well as for being a regular keynote at the world’s largest financial services conferences including SWIFT’s SIBOS, BAI in the USA, IIR in Europe and the Financial Times in the UK. When not on the circuit, Chris is Chief Executive of Balatro, a think tank on the future of financial services, and Chairman of the Financial Services Club, a UK-based group which meets regularly to debate the future of the financial markets. He is also Chairman of the Banker's Technology Awards; a Judge with the TradeTech Awards and the Asian Banker's Excellence in Retail Financial Services program; as well as a contributor to the World Economic Forum’s program focused upon the future of banking. He lives in London, England, and can be found regularly at the world's airport lounges gathering views and news on banking worldwide.

- 名人/編輯推薦

“The well-known industry prognosticator and contributor Chris Skinner has two new books coming out shortly from John Wiley…” ( Banking Technology, March 2007)

- 目次

Acknowledgments.

Introduction.

Challenges for Bankers in the 21st Century.

PART 1 GLOBAL ISSUES.

1. India and China's Impact on Global Banking.

1.1 India versus China, part one: India services the world.

1.2 India's banking: run by civil servants.

1.3 India: the future is still bright.

1.4 India versus China: part two: a Chinese take-away.

1.5 China's banking: a renovation project.

1.6 China's banking: reforming through 2007.

1.7 Lessons to be learnt from China's banks.

1.8 Conclusion: China and India are two tigers you cannot ignore.

2. The Road from Baghdad to Zurich.

3. Faith in Banking.

4. When Two Tribes Go to War.

4.1 Round one.

4.2 End of round one.

4.3 Round two.

4.4 End of round two.

4.5 Round three.

4.6 A clear knockout, but who cleans up?

5. The European Union Unravels.

6. What Goes Around Comes Around.

7 Place Your Bets.

PART 2. RETAIL BANK MATTERS.

8. Strained Relationships.

9. The Banks That Like to Say No.

10. Edupyerryr Syndrome.

11. Call Centre of the Future.

11.1 Year 2008.

11.2 Year 2010.

12. The Big Issue - Fraud and Identity Theft.

12.1 The Internet time bomb.

12.2 The real issue here.

12.3 So what is the solution?

12.4 Biometrics.

12.5 Five-level authentication.

13. Channel technologies Through 2015.

13.1 Background.

13.2 The reality of the internet revolution.

13.3 Authentication technologies.

13.4 Authentication technologies: NFC, RFID and Zigbee.

13.5 Authentication technologies: the question of identity.

13.6 Connectivity technologies.

13.7 Video over internet protocol: critical for retail banking.

13.8 The decline of the keyboard.

13.9 Summary.

13.10 Key developments in front-office banking.

14. Administration Technologies Through 2015.

14.1 The arrival of the 'always-on society'.

14.2 Principles of the 'always-on society'.

14.2.1 If you stand still, you get run over.

14.2.2 Web 2.0.

14.2.3 Application versus platform.

14.2.4 Browsers versus services.

14.2.5 Computers versus devices.

14.2.6 Language versus interface.

14.2.7 Data versus data management.

14.2.8 Users versus participants.

14.2.9 Mass marketing versus collaborative commerce.

14.3 Building the 'ever-ready bank'.

14.3.1 The connectivity and authentication hub.

14.3.2 The information routing hub.

14.3.3 The applications hub.

14.3.4 The hub foundations.

14.4 Summary.

14.4.1 Key developments in back-office banking.

PART 3. PAYMENTS MATTERS.

15. The Cashless, Cardless Society.

15.1 The cashless society.

15.2 The cardless society.

16. Corporates Demand Access.

16.1 XML is one key to the TWIST approach.

16.2 'I'm as mad as hell and I'm not going to take it anymore!

16.3 See me, hear me.

17. SWIFT Changes in Wholesale Payments.

17.1 SWIFT2010 strategy.

18. The Future of Europe's Payments.

18.1 Why force the change?

18.2 The Single Payment Area (SPA).

18.3 How is it going?

18.4 By way of example, I want some euros using my credit card.

18.5 So how have Europe's banks responded?

18.6 STEP2: the Pan-European Automated Clearing House (PE-ACH).

18.7 The melting pot boils.

18.8 The Payments Services Directive.

PART 4. INVESTMENT BANK MATTERS.

19. Best Execution With Best Intentions.

20. Make or Break for Europe's Equity Markets.

20.1 The Markets in Financial Instruments Directive (MiFID).

20.2 The end of Europe's exchanges?

20.3 What will MiFID cost?

20.4 Is that it?

21. To Trade Or Not to Trade?

22. Risky Options.

SIBOS BLOGS.

SIBOS blog 2005: Copenhagen, Denmark.

SIBOS blog 2006: Sydney, Australia.

Appendix 1. Original Articles.

Appendix 2. About Chris Skinner.

Index.

|