| FindBook |

|

有 1 項符合

Michael J. McIntyre的圖書 |

|

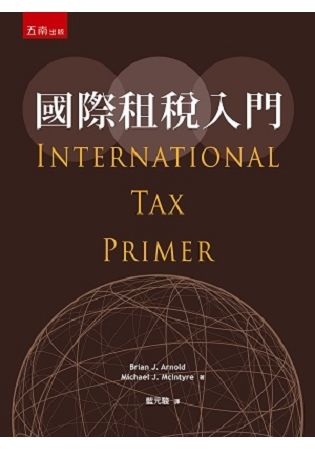

$ 378 ~ 420 | 國際租稅入門

作者:Michael J. McIntyre, Brian J. Arnold / 譯者:藍元駿 出版社:五南圖書出版股份有限公司 出版日期:2018-12-10 語言:繁體書  共 9 筆 → 查價格、看圖書介紹 共 9 筆 → 查價格、看圖書介紹

|

|

|

本書共分七章,除首章基本概述與末章新興議題,脈絡上先從國家課稅權在國際租稅環境的型態出發(第二章),其次討論課稅權衝突之避免與緩解(第三章);接著從跨國企業租稅規劃角度,探討移轉訂價(第四章)、資本稀釋、受控外國公司、離岸投資基金等避稅(防杜)機制的運作以及其在徵納關係的互動(第五章)。最後透過租稅條約的介紹進行統整,使國家與企業觀點熔於一爐(第六章)。篇幅精簡,論述則次第漸進,層次分明。

The book comprises 7 chapters. In addition to the first and last as general description and emerging issues respectively, the authors begins with the taxing power of the state in the international tax environment (ch.2), then discusses the prevention or mitigation of their conflicts (ch.3). In turn, the books takes the standpoint from international tax planning by multinational enterprises, and focuses on (anti-)tax avoidance mechanisms as transfer pricing (ch.4), thin capitalization, controlled foreign company, and offshore investment funds, etc. (ch.5) and the interaction between taxpayers and tax authorities concerned. Thirdly, the book consolidates the above perspective of state as well as that of enterprise in the section of tax treaty (ch.6). Despite its brevity, the book retains clarity and preciseness

本書特點之一,在於兩位作者來自不同稅制環境,能以比較觀點介紹國際租稅基本概念,使讀者短時間內具備相關知識,並有能力據以深入個別特殊議題。本中譯版次另收錄各地專家序文,反映最新動態及發展趨勢,更可一窺各國因應之道,極具政策研究參考價值。

A feature of the book is the different background of the two authors, which provides comparative perspective towards international tax concepts. Readers may acquire basic knowledge within manageable time while being capable of dealing with specific issues. Also included in the version of translation, are the prefaces by courtesy of tax experts, updating the latest developments and reactions in different jurisdictions and offering important insights as references to policy studies.

作者簡介:

Brian J. Arnold

加拿大稅務基金會(Canadian Tax Foundation)稅法名譽教授和資深顧問。曾在哈佛法學院(Harvard Law School)和紐約大學法學院(New York University School of Law)擔任客座教授(2005~2011),在墨爾本和悉尼法學院教授國際稅務課程(2005~2012),也擔任過多國政府、OECD和聯合國的顧問。國際財政協會(IFA)成員(2000~2007),IBFD《國際稅務專刊》的聯合編輯。

Michael J. McIntyre(1942-2013)

曾在韋恩州立大學法律學院擔任教授(Wayne State University Law School),也擔任過美國各州和各國政府的顧問,包括澳大利亞、孟加拉國、巴西、加拿大、埃及、新西蘭、秘魯、羅馬尼亞、西班牙、美國和越南。

譯者簡介:

藍元駿,臺灣大學法學士、碩士、博士。澳洲、日本、加拿大等地訪問研究。歷任中國文化大學助理教授、副教授;曾任行政院訴願審議委員、考試院命題、閱卷委員。主要以中英文寫作,其作品見於國內外學術期刊,或收錄在Springer, Economica等國際出版社所編書籍。教授之相關課程:法學緒論、英美法導論、法學外文等。

近年相關譯作:《美國法制概述》(2018)、《大陸法傳統》(2018)、《國際租稅入門》(2018)、《資本主義經濟學及其社會學—熊彼德論文選集》(2017)、《租稅正義與人權保障──葛克昌教授祝壽論文集》(2016)。

Mr. Yuan-Chun (Martin)LAN,a lawyer from LL.B (NTU), LL.M (NTU), PhD (NTU), Postdoc (NTU), studies and articles mainly on fiscal and public law in reviewed journals or collected by international publishers as Springer, Economica, etc. He has been a visiting fellow at academic institutions in Australia, Canada, Japan, etc. He started teaching at PCCU(Chinese Culture University) since 2010 and serves as member in the review committee of Hwa-Gang Law Journal, the Public and Labor Law Research Center, and as the Executive Secretary of the International Law Research Center of PCCU.Relevant courses he teaches are Introduction to jurisprudence, Anglo-American law, and Foreign Legal Languages.

Martin has a dream, which is to compile a set of multilingual, interdisciplinary tax encyclopedia. He begins its realization by translating classic works, his recent publications include:John Henry Merryman& Rogelio Pérez-Perdomo, The Civil Law Tradition—An Introduction to the Legal Systems of Europe and Latin America, Stanford University Press, (2018);E. Allan Farnsworth, An Introduction to the Legal System of the United States, Oxford University Press (2018);Brian Arnold & Michael McIntyre, International Tax Primer, Wolters Kluwer (2018);Joseph Schumpeter’s Anthology, The Capitalism of Economics and Sociology, Princeton University Press(2017); and mongraphs in : Tax Justice and Protection of Human Rights—a Festschrift for Professor Gee Keh-Chang, Sharing Publishing (2016)

所謂「國際租稅」(international tax),在用語上有其未臻精確之處。我們在此基於方便所稱的國際稅法,精確來說,指的是特定國家所得稅法的國際面向。除少數例外情形,稅法並不「國際」。它們是主權國家的產物。不存在有某種凌駕其上的國際稅法,是源自主權國家的慣習,或產生於國際主體—如聯合國(UN)、或經濟合作發展組織(OECD)—的行為。一國所得稅制最具「國際」面向的部分,應為租稅條約。多數已開發國家皆與其主要的貿易夥伴—也經常與其次要貿易夥伴—締結租稅條約。許多開發中國家也有相當廣泛的條約網絡。...

門」,則是兼指以上三種意義。

本書的主題為國際租稅。誠如我們在第一章所述,「international tax(國際租稅)」一語經常為人使用,但卻未臻理想。本書所談,實為特定國家之所得課稅的國際面向。其中,我們特別重視租稅條約和其他合作協議,它們是用來促進特定國家之所得稅制與其交易夥伴國稅制的相互協調。

本書的第一版,乃是1990年代初...

推薦序

序

第一章 序論

A. 本書目標

B. 何謂國際租稅

C. 國際租稅規則之目的

D. 稅務顧問在國際交易規劃的定位

第二章 課稅管轄權

A. 序論

B. 居住地之定義

C. 來源管轄權

第三章 雙重課稅之消除

A. 序論

B. 國際雙重課稅之定義

C. 消除機制

D. 費用分攤

E. 視同已納稅額

第四章 移轉訂價

A. 序論

B. 常規交易法

C. 分支機構或常設機構之所得認定

D. 公式化分配與常規交易法的展望

第五章 避稅防杜機制

A. 序論

B. 資本弱化條款

C. 受控外國公司法則

D. 離岸投資基金

第六章 租稅條約

A. 概覽

B...

|