●Full-length case studies: Several full-length case studies are integrated throughout the text including some of the most (in)famous derivatives disasters in history. These include Amaranth, Barings, LTCM, Metallgesellschaft, Procter & Gamble, and others. These are supplemented by other case studies available on this book's website, including Ashanti, Sumitomo, the Son-of-Boss tax shelters, and AIG.

●Extensive use of numerical examples for illustrative purposes: To enable comparability, the numerical examples are often built around a common parameterization. For example, in the chapter on option greeks, a baseline set of parameter values is chosen, and the behavior of each greek is illustrated using departures from these baselines.

●End-of-chapter problems: The book offers a large number of end-of-chapter problems. These problems are of three types:

(1)Some are conceptual, mostly aimed at ensuring that the basic definitions have been understood, but occasionally involving algebraic manipulations.

(2)The second group comprises numerical exercises; problems that can be solved with a calculator or a spreadsheet.

(3)The last group contains the programming questions; questions that challenge the students to write code to implement specific models. We were fortunate to have many Silicon Valley engineers as students, from whom we received valuable feedback on these questions.

| FindBook |

|

有 1 項符合

Sanjiv R. Das的圖書 |

|

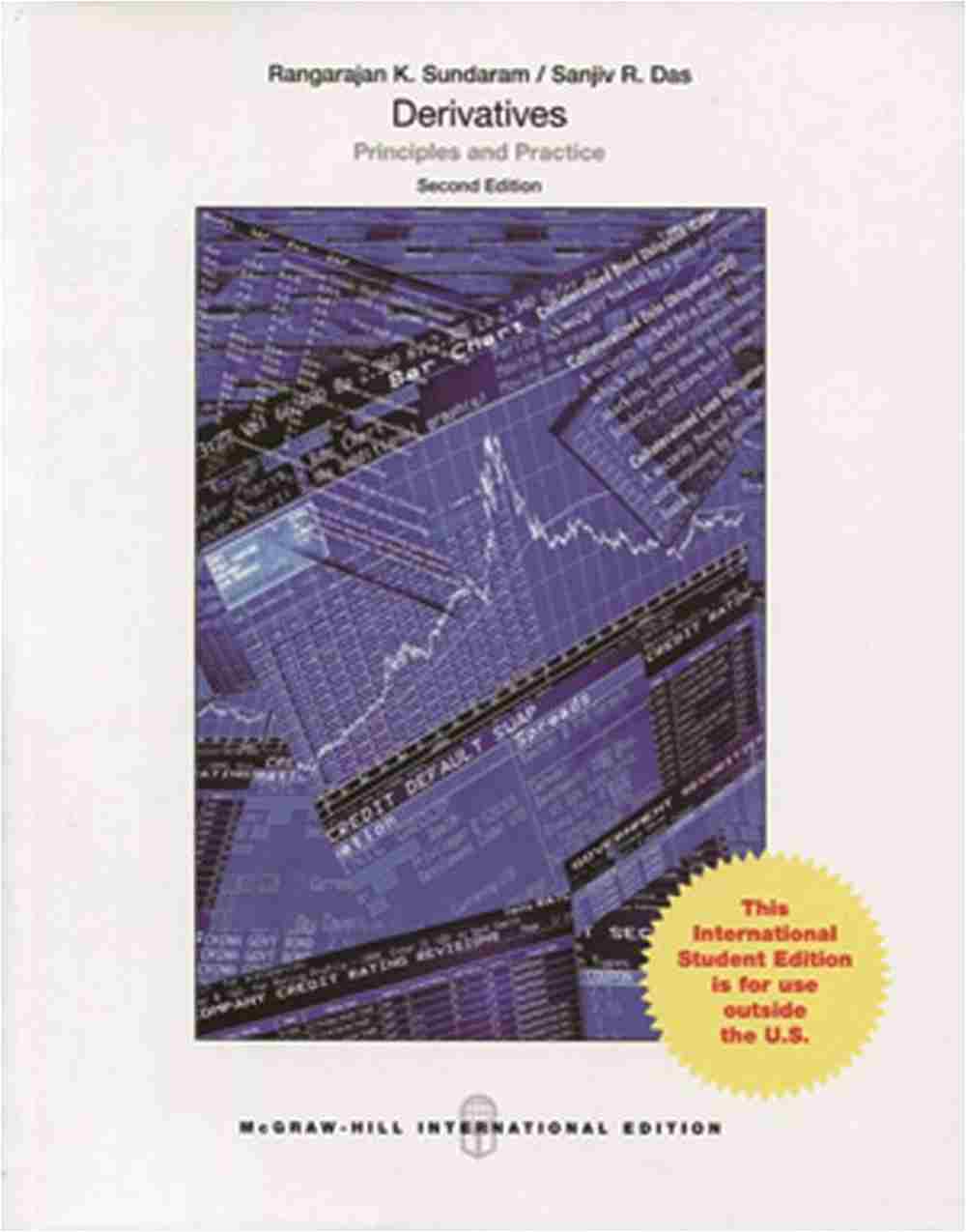

$ 1109 ~ 1180 | Derivatives:Principles and Practice(二版)

作者:Rangarajan K. Sundaram,Sanjiv R. Das 出版社:華泰文化 出版日期:2015-06-17 語言:英文 規格:平裝 / 886頁 / 普通級/ 單色印刷 / 二版  共 3 筆 → 查價格、看圖書介紹 共 3 筆 → 查價格、看圖書介紹

|

|

|

圖書介紹 - 資料來源:博客來 評分:

圖書名稱:Derivatives:Principles and Practice(二版)

內容簡介

目錄

Ch 1 Introduction

PART I: FUTURES AND FORWARDS

Ch 2 Futures Markets

Ch 3 Pricing Forwards and Futures I: The Basic Theory

Ch 4 Pricing Forwards and Futures II

Ch 5 Hedging with Futures & Forwards

Ch 6 Interest-Rate Forwards & Futures

PART II: EQUITY DERIVATIVES

Ch 7 Options Markets

Ch 8 Options: Payoffs & Trading Strategies

Ch 9 No-Arbitrage Restrictions on Option Prices

Ch10 Early Exercise and Put-Call Parity

Ch11 Option Pricing: An Introduction

Ch12 Binomial Option Pricing

Ch13 Implementing the Binomial Model

Ch14 The Black-Scholes Model

Ch15 The Mathematics of Black-Scholes

Ch16 Options Modeling: Beyond Black-Scholes

Ch17 Sensitivity Analysis: The Option “Greeks”

Ch18 Exotic Options I: Path-Independent Options

Ch19 Exotic Options II: Path-Dependent Options

Ch20 Value-at-Risk

Ch21 Convertible Bonds

Ch22 Real Options

PART III: SWAPS

Ch 23 Interest-Rate Swaps and Floating Rate Products

Ch 24 Equity Swaps

Ch 25 Currency Swaps

PART IV INTEREST RATE MODELING

Ch 26 The Term Structure of Interest Rates: Concepts

Ch 27 Estimating the Yield Curve

Ch 28 Modeling Term Structure Movements

Ch 29 Factor Models of the Term Structure

Ch 30 The Heath-Jarrow-Morton and Libor Market Models

PART V: CREDIT DERIVATIVE PRODUCTS

Ch 31 Credit Derivative Products

Ch 32 Structural Models of Default Risk

Ch 33 Reduced Form Models of Default Risk

Ch 34 Modeling Correlated Default

(The following Web chapters are available at www.mhhe.com/sd2e)

PART VI: COMPUTATION

Ch 35 Derivative Pricing with Finite Differencing

Ch 36 Derivative Pricing with Monte Carol Simulation

Ch 37 Using Octave

PART I: FUTURES AND FORWARDS

Ch 2 Futures Markets

Ch 3 Pricing Forwards and Futures I: The Basic Theory

Ch 4 Pricing Forwards and Futures II

Ch 5 Hedging with Futures & Forwards

Ch 6 Interest-Rate Forwards & Futures

PART II: EQUITY DERIVATIVES

Ch 7 Options Markets

Ch 8 Options: Payoffs & Trading Strategies

Ch 9 No-Arbitrage Restrictions on Option Prices

Ch10 Early Exercise and Put-Call Parity

Ch11 Option Pricing: An Introduction

Ch12 Binomial Option Pricing

Ch13 Implementing the Binomial Model

Ch14 The Black-Scholes Model

Ch15 The Mathematics of Black-Scholes

Ch16 Options Modeling: Beyond Black-Scholes

Ch17 Sensitivity Analysis: The Option “Greeks”

Ch18 Exotic Options I: Path-Independent Options

Ch19 Exotic Options II: Path-Dependent Options

Ch20 Value-at-Risk

Ch21 Convertible Bonds

Ch22 Real Options

PART III: SWAPS

Ch 23 Interest-Rate Swaps and Floating Rate Products

Ch 24 Equity Swaps

Ch 25 Currency Swaps

PART IV INTEREST RATE MODELING

Ch 26 The Term Structure of Interest Rates: Concepts

Ch 27 Estimating the Yield Curve

Ch 28 Modeling Term Structure Movements

Ch 29 Factor Models of the Term Structure

Ch 30 The Heath-Jarrow-Morton and Libor Market Models

PART V: CREDIT DERIVATIVE PRODUCTS

Ch 31 Credit Derivative Products

Ch 32 Structural Models of Default Risk

Ch 33 Reduced Form Models of Default Risk

Ch 34 Modeling Correlated Default

(The following Web chapters are available at www.mhhe.com/sd2e)

PART VI: COMPUTATION

Ch 35 Derivative Pricing with Finite Differencing

Ch 36 Derivative Pricing with Monte Carol Simulation

Ch 37 Using Octave

|